ASSESSMENTS

Ethiopia Offers Investors a Tantalizing, If Tainted, Promise

Nov 22, 2018 | 10:00 GMT

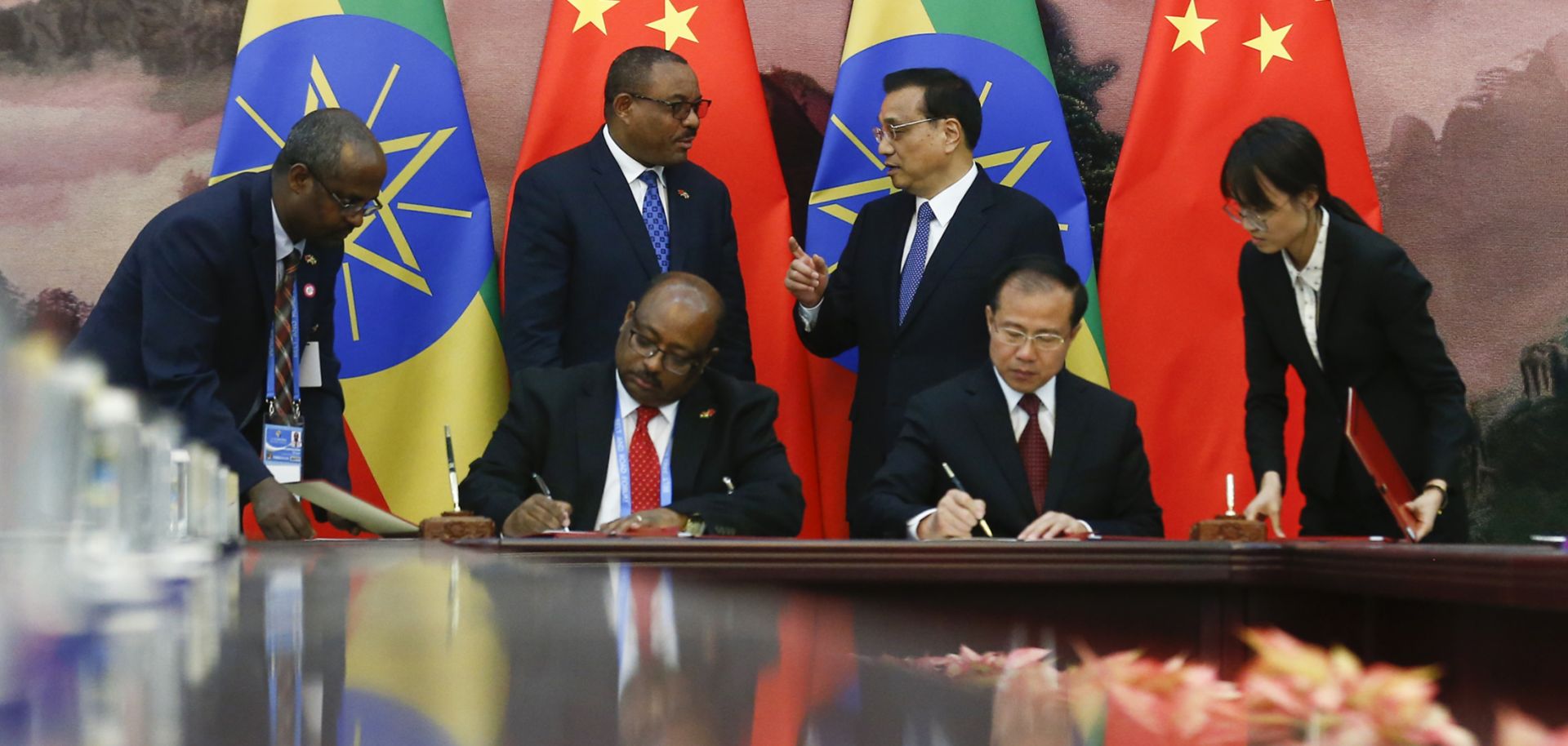

Chinese Premier Li Keqiang and then-Ethiopian Prime Minister Hailemariam Desalegn attend a signing ceremony at the Great Hall of the People in Beijing on May 12, 2017. China has invested heavily in Ethiopia, but questions remain as to Addis Ababa's ability to pay back the loans from Beijing.

(THOMAS PETER - POOL/Getty Images)

Highlights

- Addis Ababa will proceed carefully toward the partial privatization of large state-owned enterprises like Ethio Telecom, Ethiopian Airlines and others in 2019.

- Ultimately, the transparency of the process will give investors key insight into the government's intentions regarding privatization.

- Ethiopia's rising economic potential will drive further investment interest from non-Western countries like China and Vietnam.

- Investors' appetites to take on additional risk will depend greatly on whether Ethiopia's recently completed infrastructure projects are perceived as successful.

- Although the partial privatization of state-owned enterprises may spark an uptick in investment, Addis Ababa will need to undertake deeper structural economic reform to improve growth and foster greater internal stability.

Subscribe Now

SubscribeAlready have an account?