A 25 percent tariff imposed by the United States on $200 billion worth of Chinese goods will primarily hit exports of electronic parts and machinery. Altogether, these losses will account for an estimated 35 percent of the total damages inflicted on Chinese exports as a result of U.S. tariffs. The looming tariff excludes consumer goods with the thinnest margins and highest labor intensity, such as toys, garments and shoes, which are among China's top five exports to the United States. Still, the tariff will hit many consumer manufacturers hard, including companies making furniture, auto parts and leathers. This is in part because of lower profit margins in those industries — around 5 percent — and their higher reliance on sales to the United States.

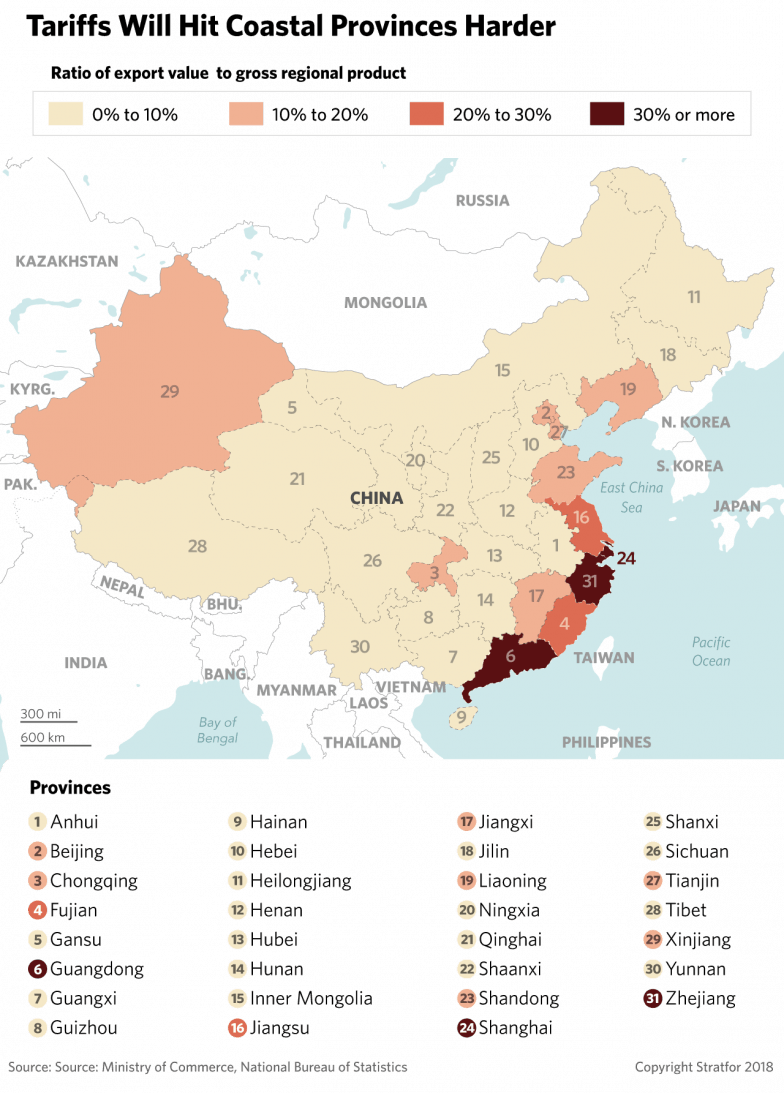

Chinese coastal provinces and cities will bear the brunt of the import tax. Guangdong, Shanghai, Zhejiang, Jiangsu and Fujian, whose exports account for over 30 percent of China's gross domestic product, will acutely feel the economic and employment stress. In particular, exports of electronic machinery — a major U.S. tariff target — account for over 60 percent of total exports for three key provinces: Guangdong (67.8 percent), Jiangsu (65.8 percent) and Shanghai (around 60 percent). Jiangsu and Shandong are also among the top indebted provinces in China. While they are better off compared to their central and western counterparts, the looming trade war will constrain the local and central government's ability to mitigate the adversarial effects of U.S. tariffs.